Product Based Sales Training Market Size and Share

Product Based Sales Training Market Analysis by Mordor Intelligence

The product-based sales training market size stood at USD 5.29 billion in 2025 and is forecast to reach USD 7.32 billion by 2030, reflecting a 6.74% CAGR during the outlook period. Enterprises are scaling investments to help sellers master intricate product ecosystems and buyer-led purchasing journeys, while AI-powered micro-coaching lifts win rates by 14% and quota attainment by 6.6%. Virtual instructor-led platforms (VILT) post the fastest revenue expansion as they compress delivery costs and boost reach, yet instructor-led classroom formats still command the largest revenue slice. Sectoral momentum stems from Consumer Goods & Retail networks, mid-market enterprise expansion, and AI-native platforms that personalize learning paths. Regional growth is led by Asia-Pacific’s mobile-first culture, whereas North American budgets sustain global-scale programs and early technology adoption.

Key Report Takeaways

- By training delivery mode, instructor-led classroom formats held 39.31% of product-based sales training market share in 2024; VILT is projected to accelerate at a 7.12% CAGR through 2030.

- By industry vertical, Consumer Goods & Retail generated 25.53% revenue in 2024, while IT & Telecom is set to advance at an 8.31% CAGR to 2030.

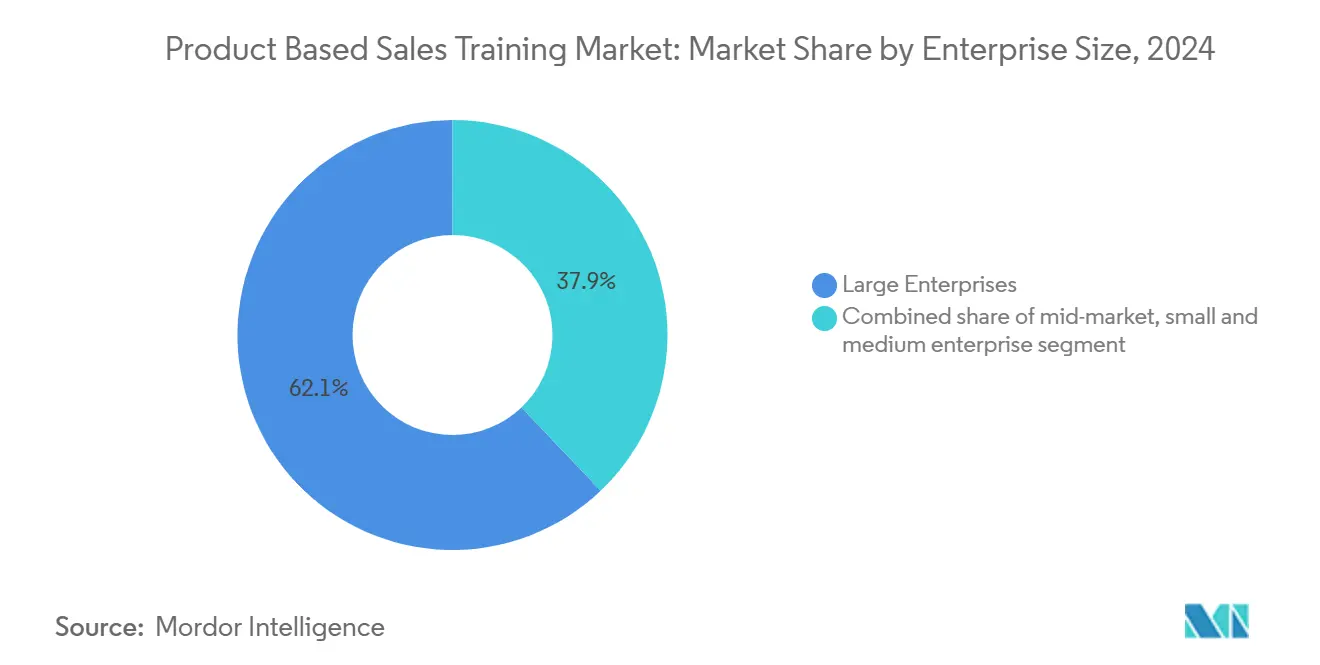

- By enterprise size, large enterprises captured 62.12% of 2024 revenue; the mid-market segment is forecast to grow at a 6.91% CAGR.

- By geography, North America accounted for 41.71% of global revenue in 2024, whereas Asia-Pacific is poised for an 8.91% CAGR over the forecast window.

Global Product Based Sales Training Market Trends and Insights

Drivers Impact Analysis

| Driver | (~) % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Rapid shift toward e-Learning & VILT | +1.2% | Global with APAC leadership | Medium term (2–4 years) |

| Need to accelerate product launch sales readiness | +0.8% | North America & EU | Short term (≤2 years) |

| Investment boom in integrated LMS/CRM suites | +0.9% | Global, enterprise focus | Medium term (2–4 years) |

| Increasing complexity of SaaS & PLG models | +0.7% | North America expanding to APAC | Long term (≥4 years) |

| AI-powered micro-coaching funding surge | +0.6% | North America & EU, spillover to APAC | Medium term (2–4 years) |

| Buyer-led digital product trials need value-orchestration skills | +0.5% | Global, B2B focused segments | Long term (≥ 4 years) |

| Source: Mordor Intelligence | |||

Rapid Shift Toward e-Learning & VILT

VILT combines real-time collaboration with the reach of digital delivery, enabling organizations to cut travel costs by up to 60% while maintaining instructor interaction levels. Built-in analytics track learner engagement at the moment of content consumption, allowing program managers to refine modules continuously. Mobile-first Asian enterprises champion the model because sessions stream seamlessly on smartphones, aligning with regional work patterns[1]Ryann K. Ellis, “Asia: M-Learning's Sweet Spot,” ATD, TD.ORG . Personalization engines further heighten retention by adapting content to each seller’s proficiency and role. As remote selling becomes a norm, VILT is moving from supplementary delivery to the centerpiece of enterprise enablement.

Need to Accelerate Product Launch Sales Readiness

Shortened product life cycles require sales teams to master specifications, positioning, and objection handling in weeks rather than months. Simulation-based practice environments now replicate live demos, trimming time-to-competency by up to 40%. North American and European firms face particularly intense launch pressures, spurring uptake of just-in-time micro-learning modules accessed within CRM workflows. Faster readiness directly links to earlier revenue capture when first-mover advantages are most acute. Firms that compress ramp-up periods achieve a higher share of wallet in the pivotal first 90 days post-launch. As competitive intensity amplifies, companies are embedding AI-driven coaching to personalize training sequences based on individual performance gaps. This results in more consistent messaging at launch, reducing variability in deal outcomes across regions.

Investment Boom in Integrated LMS/CRM Enablement Suites

Enterprises now seek platforms that correlate learning progress with revenue metrics to spotlight gaps hindering deal closure. Investors have rewarded vendors such as Mindtickle, whose more than USD 1 billion valuation underscores the premium on data-rich ecosystems. Integrated suites reveal how certification status relates to pipeline health, enabling predictive prompts that trigger role-specific refreshers. Unified data also simplifies executive reporting, satisfying finance leaders who demand visibility into training ROI. As learning, content management, and analytics converge, point solutions risk obsolescence. With buying committees prioritizing end-to-end platforms, the competitive landscape is shifting decisively toward vendors that offer natively connected workflows over bolt-on integrations.

Increasing Complexity of SaaS & PLG Models

Product-led growth flips the traditional funnel, letting prospects self-educate through free tiers before interacting with sales. Reps must interpret usage telemetry to spot inflection points where human guidance boosts expansion or upsell. That dual fluency in product and data analysis calls for curricula that pair technical walkthroughs with behavioral analytics modules. Early-stage user insights steer consultative conversations toward value orchestration instead of generic pitches. Programs that embed these skills equip reps to convert freemium interest into enterprise contracts with higher lifetime value. As renewal cycles become more usage-driven, enablement must continuously reinforce these competencies to prevent churn and strengthen expansion paths.

Restraints Impact Analysis

| Restraint | ( ~ ) % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Proving ROI & attribution to revenue | −0.9% | Global, cost-conscious markets | Short term (≤2 years) |

| Training budget compression during economic slowdowns | −0.6% | Global, cyclical industries | Short term (≤2 years) |

| High sales-force turnover diluting training impact | −0.4% | Global, severe in high-growth markets | Medium term (2-4 years) |

| Shadow-enablement causing message drift | −0.3% | North America & EU, spreading to APAC | Medium term (2-4 years) |

| Source: Mordor Intelligence | |||

Proving ROI & Attribution to Revenue

Roughly 90% of programs still struggle to link learning outcomes to improved sales, eroding stakeholder confidence[2]Duane Sparks, “90% of All Sales Force Training Fails,” Action Selling, ACTIONSELLING.COM . Extended B2B cycles compound the attribution puzzle because performance indicators surface months after training. Modern platforms capture seat-time, engagement scores, and certification status, yet many companies lack the analytical rigor to connect those signals to closed-won revenue. Governance models that blend finance, enablement, and sales operations teams have begun to formalize ROI frameworks, but adoption remains patchy. Until quantifiable gains are evident, budget approvals face persistent scrutiny.

Training Budget Compression During Economic Slowdowns

Global growth deceleration from 3.5% in 2022 to 2.9% in 2024 prompted finance leaders to triage discretionary spending[3]International Monetary Fund, “World Economic Outlook: Navigating Global Divergences,” IMF.ORG. Training allocations often suffer first despite evidence that well-trained teams win 52.6% of deals versus 40.5% for under-trained peers. Industries with cyclical demand, such as automotive or heavy manufacturing, tighten cash flow controls most aggressively, stretching refresh cycles beyond optimal cadences. Progressive firms counteract cuts by migrating to pay-per-use digital libraries, preserving learning continuity without large upfront commitments. Historical data shows that organizations maintaining capability development during recessions rebound faster once demand returns.

Segment Analysis

By Training Delivery Mode: Virtual Platforms Accelerate Market Evolution

The segment anchored by instructor-led classroom formats generated the largest revenue slice, accounting for 39.31% of the product-based sales training market in 2024. However, the digital pivot positions VILT as the growth engine, expanding at a 7.12% CAGR through 2030 as enterprises chase cost efficiency and geographical reach. In 2025, VILT deployments contributed markedly to product-based sales training market size gains, reinforcing the strategic shift toward scalable delivery. Classroom programs now integrate collaborative whiteboards and streaming simulations to preserve experiential learning while phasing out travel-heavy logistics.

Organizations further diversify with self-paced eLearning for asynchronous modules and blended designs that merge virtual cohorts with periodic in-person intensives. Data captured from virtual sessions feeds AI models that personalize subsequent assignments, demonstrating higher knowledge retention than one-size curricula. The granular telemetry also satisfies finance leaders’ demand for ROI evidence by mapping learning milestones to pipeline velocity. As the hybrid workplace becomes entrenched, delivery-mode flexibility shifts from convenience to a mandatory requirement for global consistency.

Note: Segment shares of all individual segments available upon report purchase

By Industry Vertical: Technology Sectors Drive Innovation Adoption

Consumer Goods & Retail retained the highest revenue share at 25.53% in 2024 as sprawling product catalogs necessitated continuous upskilling on features and merchandising. The IT & Telecom vertical, fueled by cloud, cybersecurity, and SaaS complexity, achieved the fastest 8.31% CAGR, lifting its contribution to the overall product-based sales training market size. Multi-solution bundles and subscription-billing models intensify the need for sellers to navigate cross-functional buying centers. Companies in this sector increasingly demand adaptive learning paths that account for rapid product roadmap changes. As a result, vendors are incorporating AI-based personalization engines to keep content dynamically aligned with evolving technology stacks.

Healthcare & Life Sciences sustained solid uptake owing to regulatory compliance demands and frequent therapeutic launches. Manufacturing and Automotive emphasized technical application training, while BFSI integrated modules on digital transformation and regulatory shifts. The rise of technology-centric courses spurs providers to recruit subject-matter experts who translate deep product knowledge into digestible sales narratives. Precision in clinical positioning and device functionality requires granular scenario-based simulations that mirror real-world buyer objections. Consequently, continuous micro-credentialing has emerged as a critical differentiator for vendors targeting highly regulated industries.

By Enterprise Size: Mid-Market Expansion Drives Growth Acceleration

Large enterprises captured 62.12% of revenue due to robust budgets and established enablement infrastructure that can absorb platform rollouts at scale. Their procurement influence shapes vendor roadmaps, particularly around API integrations with existing HR and CRM stacks. Mid-market firms, while smaller in absolute spend, recorded the swiftest growth at 6.91% CAGR, signaling an inflection point where structured enablement becomes vital to sustain expansion. This cohort boosts the addressable product-based sales training market share by demanding solutions that balance enterprise-grade analytics with turnkey deployment. Mid-sized buyers increasingly expect rapid time-to-value, pushing vendors to offer pre-configured industry templates and outcome-based pricing. As competition heats up, providers are tailoring feature sets that transition smoothly as customers scale from mid-market into enterprise tiers.

Cloud-delivered platforms appeal to mid-market buyers by eliminating heavy IT lift and providing modular pricing tiers. Meanwhile, small and micro-enterprises cherry-pick tactical courses focused on immediate revenue pain points, often through pay-as-you-go libraries. As vendors refine self-service onboarding and out-of-the-box templates, adoption barriers for resource-tight firms continue to fall. The democratization of advanced analytics within lighter-weight packages makes strategic enablement attainable for even lower revenue companies. Consequently, the lower end of the market is evolving from ad-hoc training toward structured, metric-driven programs.

Note: Segment shares of all individual segments available upon report purchase

Geography Analysis

North America accounted for 41.71% of 2024 revenue, anchored by sizable budgets, early AI adoption, and a concentration of leading training providers that shape global standards. U.S. companies emphasize data-driven ROI, driving integration of learning analytics with pipeline visibility tools. Canadian firms follow closely, leveraging bilingual programs to serve domestic and cross-border markets, while Mexico’s manufacturing hubs expand training to support near-shoring supplier networks.

Asia-Pacific is the fastest-growing territory at an 8.91% CAGR through 2030, propelled by mobile-first learning cultures and sweeping digital transformation agendas across China, India, and Southeast Asia. Two-thirds of decision makers in the region already use or plan to adopt mobile learning solutions. Investments in 5G and smartphone proliferation make bite-sized modules the default for distributed sales forces. Japanese and South Korean enterprises elevate analytics sophistication, while ASEAN markets attract global vendors through joint ventures and localized content.

Europe sustains steady expansion by layering compliance-driven modules atop existing classroom traditions. Multinational companies demand language-localized content that accommodates diverse regulatory frameworks. South America and the Middle East & Africa register emerging momentum as enterprises prioritize capability development to capture export growth and domestic consumption. Regional governments’ push for digital skills indirectly lifts demand for commercial sales programs, further widening the product-based sales training market footprint.

Competitive Landscape

The product-based sales training industry remains moderately fragmented, with legacy consulting-driven providers facing disruption from AI-native platforms that deliver granular data and personalized pathways. Incumbents such as Sandler, Richardson, and Wilson Learning retain strong brand equity through decades of intellectual property and client loyalty, yet they race to embed adaptive engines and real-time analytics to stay relevant. With entry barriers lowering due to SaaS delivery and digital distribution models, niche specialists are also emerging to target underserved verticals with hyper-tailored offerings.

Strategic M&A signals consolidation toward full-suite capability. Alchemist’s November 2024 acquisition of RAIN Group fused U.K. learning expertise with Boston-origin sales methodology to broaden global reach. Similarly, BTS Group acquired Thailand’s top leadership-development firm in July 2024 to solidify its Asia-Pacific presence. Funding trends also favor tech-rich challengers; Mindtickle’s valuation surge underscores capital’s tilt toward integrated LMS-CRM-coaching ecosystems. As geopolitical considerations reshape supply chains and regional training mandates, cross-border acquisitions are expected to continue as a key growth lever.

Competitive differentiation now hinges on measurable impact. Korn Ferry’s rollout of AI tools that surface predictive coaching prompts exemplifies the shift from curriculum libraries to outcome-oriented solutions. Providers unable to quantify lift in win rates or ramp-time reductions risk commoditization. As buyers consolidate vendor lists, partnerships with CRM, CPQ, and revenue-intelligence platforms become pivotal for retention and upsell. In this environment, vendors are also investing in customer success teams to ensure ongoing adoption and demonstrable ROI beyond initial implementation.

Product Based Sales Training Industry Leaders

-

Sandler

-

Korn Ferry

-

Richardson Sales Performance

-

RAIN Group

-

Challenger Inc.

- *Disclaimer: Major Players sorted in no particular order

Recent Industry Developments

- May 2025: Selling Power reported that AI-driven onboarding lifted win rates by 14% and quota attainment by 6.6% among early adopters.

- April 2025: Destination CRM highlighted 2025 trends, emphasizing prescriptive, generative-AI training tailored to individual skill gaps.

- February 2025: SBI Growth research revealed 87% of enablement teams juggle multiple roles, yet only 39% possess enough staff to cover them, spotlighting resource challenges.

- February 2025: Training Industry released its 2025 Top Training Companies list, recognizing innovators driving the product-based sales training market.

Global Product Based Sales Training Market Report Scope

| Instructor-Led Classroom |

| Virtual Instructor-Led (VILT) |

| Self-paced eLearning |

| Blended / Hybrid |

| IT & Telecom |

| BFSI |

| Manufacturing |

| Healthcare & Life Sciences |

| Consumer Goods & Retail |

| Automotive |

| Large Enterprises |

| Mid-market |

| Small & Micro-enterprises |

| North America | United States |

| Canada | |

| Mexico | |

| South America | Brazil |

| Peru | |

| Chile | |

| Argentina | |

| Rest of South America | |

| Europe | United Kingdom |

| Germany | |

| France | |

| Spain | |

| Italy | |

| BENELUX (Belgium, Netherlands, Luxembourg) | |

| NORDICS (Denmark, Finland, Iceland, Norway, Sweden) | |

| Rest of Europe | |

| Asia-Pacific | India |

| China | |

| Japan | |

| Australia | |

| South Korea | |

| South-East Asia | |

| Rest of Asia-Pacific | |

| Middle East & Africa | United Arab Emirates |

| Saudi Arabia | |

| South Africa | |

| Nigeria |

| By Training Delivery Mode | Instructor-Led Classroom | |

| Virtual Instructor-Led (VILT) | ||

| Self-paced eLearning | ||

| Blended / Hybrid | ||

| By Industry Vertical | IT & Telecom | |

| BFSI | ||

| Manufacturing | ||

| Healthcare & Life Sciences | ||

| Consumer Goods & Retail | ||

| Automotive | ||

| By Enterprise Size | Large Enterprises | |

| Mid-market | ||

| Small & Micro-enterprises | ||

| By Geography | North America | United States |

| Canada | ||

| Mexico | ||

| South America | Brazil | |

| Peru | ||

| Chile | ||

| Argentina | ||

| Rest of South America | ||

| Europe | United Kingdom | |

| Germany | ||

| France | ||

| Spain | ||

| Italy | ||

| BENELUX (Belgium, Netherlands, Luxembourg) | ||

| NORDICS (Denmark, Finland, Iceland, Norway, Sweden) | ||

| Rest of Europe | ||

| Asia-Pacific | India | |

| China | ||

| Japan | ||

| Australia | ||

| South Korea | ||

| South-East Asia | ||

| Rest of Asia-Pacific | ||

| Middle East & Africa | United Arab Emirates | |

| Saudi Arabia | ||

| South Africa | ||

| Nigeria | ||

Key Questions Answered in the Report

What is the projected revenue for the product-based sales training market in 2030?

The market is expected to reach USD 7.32 billion by 2030, expanding at a 6.74% CAGR from its 2025 baseline.

Which delivery mode is growing fastest within product-focused sales enablement?

Virtual instructor-led training (VILT) is forecast to grow at a 7.12% CAGR, the highest across delivery formats.

Which vertical contributes the largest revenue today?

Consumer Goods & Retail leads with 25.53% of 2024 global revenue.

Why is Asia-Pacific the fastest-growing region?

Mobile-first learning cultures, large enterprise expansions, and digital transformation initiatives drive an 8.91% CAGR.

Page last updated on: